Where Luxury Meets Style and Comfort

MT Real Estate Group is the most premier, boutique brands that provide excellent services & results

LATEST NEWS

By Philip Molnar

•

April 16, 2025

San Diego voted Tuesday to ban software that it says is being used to illegally raise residential rents. The city council targeted software used by Texas company RealPage, which has been in federal crosshairs since August when the Biden administration filed an antitrust lawsuit against it. The Justice Department claimed the software’s algorithm allows landlords to view confidential information across competitors to align prices, avoid competition and keep rents high. RELATED: RealPage sues Berkeley over its ban on algorithmic rent pricing software San Diego, in an 8-to-1 vote, joins other cities that have banned the software, including Berkeley, San Francisco and Minneapolis. RealPage has sued Berkeley , is fighting the federal lawsuit and has not ruled out suing other cities that have banned its software. “This software weaponizes private data, from what should be competing landlords, to figure out just how high they can push prices,” said Councilmember Sean Elo-Rivera at a press conference ahead of the vote. RealPage attorney Michael Semko told the council it simply offers analysis of the rental market with a pricing suggestion, and less than 40% of the time do its clients go with the suggestion. “We don’t set rents,” he said. “The only way to lower rents is to build more housing. I think the ordinance is overly broad, it’s vague and invites scrutiny.” RealPage takes the data of millions of apartments, from hundreds of landlords, to give a user advice on what to charge a tenant. Landlords can still view signs outside of other apartment buildings or go on other complexes’ websites to see competing offers and figure out what to charge. The legal argument against RealPage is that it takes what should be confidential information from real estate management companies — such as exactly what a landlord is charging, instead of just viewing posted asking rents on websites — and incentivizes multiple landlords to collude on price. RealPage denies collusion allegations. It says its software might recommend to keep rents lower, or flat. It also says cities that ban its software are infringing on the company’s free speech rights to offer advice on rents. Lucinda Lilley, an apartment specialist who consults for several property management firms in San Diego County, told the Union-Tribune earlier this week that she does not use RealPage but was concerned about the ordinance because it constrains data gathering that businesses need. She said it sounded like the city didn’t want property managers to even conduct market surveys to figure out what rents are in the area. “What’s concerning is how far they want to go,” Lilley said. Elo-Rivera said the ordinance is only aimed at nonpublic competitor data, not public housing data sites, like Redfin and Zillow, or market surveys of rent prices. He said he worked closely with the city attorney to craft an ordinance not as broad as the Berkeley law, which didn’t expressly define the difference between noncompetitive, or nonpublic, data and public sources. The San Diego ordinance contains a carveout for landlords to use software from systems like RealPage after the data is 90 days old (nonpublic data not recommending rents). He argued the threat of a lawsuit was not reason enough to back off. “We can’t control whether or not folks sue,” Elo-Rivera said. “What I do know is I’m not going to be intimidated by big corporate executives and their threats to sue us to get us to try and not protect consumers.” The San Diego ordinance says if a tenant finds out their landlord is using rental algorithm software, they may seek damages of up to $1,000. Lilley said that was a concern for property managers because the law is targeting them for buying software, as opposed to going after RealPage directly. The ordinance does not specifically mention RealPage, only “algorithmic devices” used for rental rates, but the staff report cites RealPage several times as a justification for the action. The San Diego City Council voted 4-1 in October to have city staff frame an ordinance targeting the rental software. Only Councilmember Raul Campillo voted against out of concern it would get in the way of nationwide or statewide legal action against RealPage. On Tuesday, he again cast the lone dissenting vote, this time because of concern over specific language he wanted to add concerning a subsection of the ordinance. The law comes as San Diego County rent as been largely flat for more than a year. Real estate tracker CoStar said the average rent in the county, across all room types, was $2,513 a month, an annual rise of 0.6%, in mid-April. However, county rent has risen significantly since the start of the pandemic when average rent was $2,005 a month, representing a 25% gain in five years. The council meeting was attended by about 50 people, almost all in favor of banning the software. They held signs that said “Stop Price Fixing” and “Housing for All.” Alana Martinson, with Serving Seniors, said the low-income San Diegans her organization serves are devoting much of their fixed income to rent. “Older adults on fixed incomes are especially vulnerable to rent hikes,” she said. “A $100 increase, based on an algorithm, not real market conditions, can be catastrophic.” Recent UC San Diego graduate Nicole Lillie, who now works with youth-led nonprofit Our Time to Act, said many of her fellow graduates have left San Diego because they can’t afford to live here. “Our society, and its systems, have placed profit over people,” she said. “Gluttonous corporations, and landlords, find a million ways to squeeze every last penny from renters. One of their newest tactics has been using algorithms to artificially inflate our rents.” RealPage is facing additional lawsuits by the attorney generals of North Carolina and California. As San Diego’s city council was meeting, the North Carolina attorney general announced a settlement with one landlord, Cortland, who was sued for using RealPage. The company agreed to no longer use the software. North Carolina’s lawsuit against RealPage, and five other landlords, is ongoing.

By Sierra Lopez

•

April 16, 2025

PINOLE — Plans to build 154 homes on a 7.7-acre lot in Pinole cleared another hurdle Monday after planning commissioners approved a final map for the Appian Village project. Northern California housing developer DeNova Homes has been seeking to build its 154-unit residential project at 2151 Appian Way since 2021. The proposal calls for the construction of 26 three-story buildings, which would include both stacked flats and townhomes ranging in size from 1,249 to 1,825 square feet. The project will result in fully electric homes, 20% of which will be affordable units, according to city planning documents. Of the below-market-rate units, 15% will be listed at the moderate level for people earning up to 120% of the county’s median income and 5% will be at the low-income category for people earning up to 80% of the county’s median income. In Contra Costa County, the median income is $109,000 annually for a single-person household with a single low-income earner making about $84,600 and a moderate income earner making at least $130,800 per year, according to California Department of Housing and Community Development 2024 income levels. The homes will be built just south of Maloney Reservoir, across the street from Pinole Middle School on the former site of Doctors Medical Center, which closed in 2000 . The boarded up medical campus was demolished to make way for the new residential development. New infrastructure, including water, sewage and storm drainage, curbs, sidewalks, pedestrian paths and outdoor space will also be developed under the plan, according to city documents. Planning commissioners asked few questions and gave little feedback on the proposal during its Monday meeting but the project had already received various approvals in 2022, including an environmental review exemption, a comprehensive design review and a tentative subdivision map. The commission voted unanimously Monday to approve a final subdivision map, finding that it aligned with the tentative version adopted in 2022. Pinole Planning Manager David Hanham lauded the maps for their near identical configurations and said the DeNova development team has been easy to work with. “We’ve got a good working relationship with them and continue to move this project forward,” Hanham said Monday. Hanham and representatives with DeNova Homes did not immediately respond to requests for comment from this news organization.

By George Avalos

•

April 16, 2025

SAN JOSE — A developer is eyeing a “builder’s remedy” to fast-track well over 700 affordable homes in north San Jose’s Alviso district — and city planners say they are working with the developer to advance the project. The proposed development of 780 affordable residences would sprout next to the popular Topgolf entertainment and sports venue near North First Street, according to plans on file with San Jose city officials. he project’s developer, Cloud Apartments, hopes to determine whether the north San Jose project might land city approval through a fast-track builder’s remedy or a streamlined proposal. When cities or counties in California are out of compliance with state rules because they haven’t met their housing approval obligations, the builder’s remedy approach gives developers a way to overcome local barriers that can throttle affordable housing proposals. The 780-unit affordable housing proposal would be built on a 3.2-acre site at 7 Topgolf Way in Alviso, the planning documents show. “It’s important for the city to encourage more affordable housing near major job clusters like north San Jose,” said Bob Staedler, principal executive with Silicon Valley Synergy, a land-use consultancy. Years ago, the development site was part of the land that would have been needed for an “entertainment district” of restaurants, shops, hotels, and lively gathering places near the interchange of State Route 237 and North First Street. For an array of reasons, the entertainment district proposal fizzled, and the plans fell by the wayside. Now, this housing development and a nearby data center complex are poised to sprout on sites that would have provided the land for the entertainment district. Cloud Apartments, which uses modular construction techniques to save money and speed up production of affordable housing, is the developer of the proposed 780-unit complex. The housing developer is attempting to use provisions of two different state laws in hopes of a successful navigation of San Jose’s complex approval process. City planners are engaging with Curtis Wong, chief executive officer and founder of Cloud Apartments, on this project. “We are working closely with the developer on this,” Marika Krause, a public information manager with the San Jose Planning Department, said in an interview with this news organization. This proposal has emerged at a time when affordable housing is in demand in the Bay Area and San Jose. “We are happy they are building affordable housing there,” Krause said. In recent months, city planners issued a letter to the developer that sketched out some obstacles to the project that could have hobbled the development efforts. California’s builder’s remedy rules, however, are evolving, and the changes have left the city-issued letter outdated. “We are working sincerely with the applicant to allow their proposed density,” Krause said. “Builder’s remedy is a complicated law that’s been clarified a few times” in recent months. San Jose’s shifting assessment of the builder’s remedy rules is helpful, in Staedler’s view. “It appears the city is becoming more receptive to these kinds of projects than they were in the past,” Staedler said. “Getting more housing in north San Jose is always helpful.”

By Ryan Macasero

•

April 16, 2025

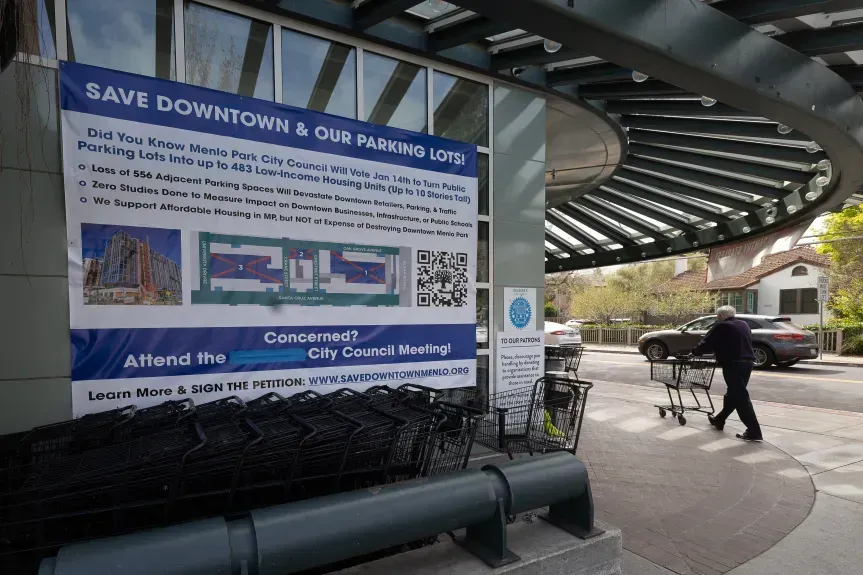

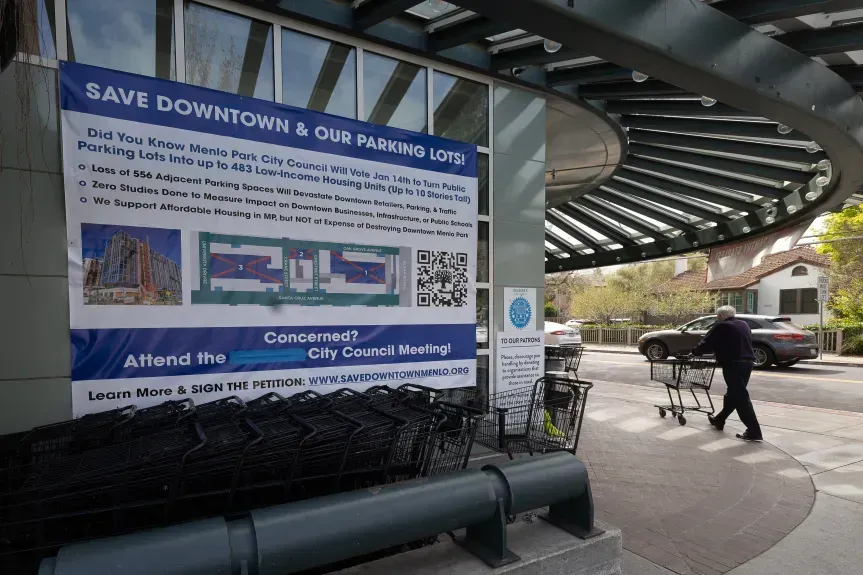

A group of downtown business leaders is suing the city of Menlo Park in an effort to block a proposed redevelopment of three parking lots into at least 345 units of affordable housing . The alliance, Save Downtown Menlo Park, filed a lawsuit against the city on Monday to stop its request for developer qualifications for the parking lots and to completely cancel that process. The lawsuit seeks to compel the city to follow the state’s Surplus Land Act, arguing the land must be declared surplus before development proposals can be considered. The group is also requesting the city pay their legal fees. City officials confirmed Wednesday that they are aware of the lawsuit but had not yet been formally served. “The city is releasing this information for transparency while it reviews the filing,” Menlo Park said in an emailed statement Wednesday. The complaint centers on whether the city has the legal authority to redevelop parking plazas 1, 2, and 3, located off Santa Cruz Avenue at Maloney Lane, Chestnut Street, and Crane Street. Opponents of the potential project argue that the redevelopment will remove more than 500 parking spaces, which they say will severely impact small business revenues, even if the removal is temporary. However, proponents and affordable housing advocates stress the urgency of building housing quickly on all available sites as the region grapples with a worsening housing crisis. Save Downtown Menlo Park argues the lots were acquired, at least in part, through eminent domain in the 1950s and that the city holds them in a “fiduciary capacity” — essentially acting as a trustee for public use, not for private development. The group points out that downtown property owners continue to pay special assessments to fund and maintain the parking, reinforcing their claim. The city disputes that interpretation. In a previous email to this news organization, Assistant City Manager Stephen Stolte said he was not aware of any law “that grants assessment payers a vested right in the assessment district improvements, provides that improvements shall perpetually remain in the same form, or provides that improvements may not later be changed or abandoned in the public interest.” The lawsuit also claims the city violated California’s Surplus Land Act by deferring a formal declaration that the land was surplus earlier this year — a legal step required before publicly owned land can be sold or leased — while still advancing the request for qualifications process. The city has not responded to that specific allegation as it continues to review the complaint. Seven developers have already submitted proposals, including Alliant Communities, Eden Housing, MidPen Housing, Path Ventures, Presidio Bay Ventures, Related California and Alta Housing, and The Pacific Companies and West Development Partners. All proposals include plans to replace or address parking and signal a willingness to collaborate with local stakeholders. Save Menlo Park’s lawyers have not responded to requests for comment. Since launching its campaign earlier this year, Save Downtown Menlo Park has collected more than 3,585 petition signatures and raised over $146,000 — mostly for legal expenses. Kevin Cunningham, a downtown property owner and one of the group’s lead organizers, previously said the city’s decision to move forward with the proposals has deepened frustration among business owners already uneasy about the city’s economic climate. The group, which maintains it is not anti-housing, has suggested that the city consider alternative sites — such as the Civic Center, two blocks away — to avoid disrupting downtown parking. Housing advocates argue that all viable sites must be considered to meet urgent demand. In addition to opposition from project critics, Menlo Park faces pressure from both state officials and local advocates to increase housing production, particularly in one of the region’s most expensive cities, home to tech giant Meta and several major venture capital firms. Amid a severe housing crisis, state regulators have in recent years been closely monitoring cities’ compliance with housing laws. Failure to follow through on approved housing plans — officially known as housing elements — can lead to decertification, exposing cities to the “builder’s remedy,” a legal tool that allows developers to bypass local zoning if 20% of the proposed units are affordable. Noncompliant cities also risk losing access to state and federal grants. Menlo Park’s state-approved housing element outlines plans for nearly 3,000 new homes by 2031. Across the Bay Area, cities are collectively targeting the construction of 442,000 units during the same period, according to the Association of Bay Area Governments.

By Bay City News Service

•

April 13, 2025

The Marin County Board of Supervisors is considering a $5.2 million loan to support an 80-unit Habitat for Humanity housing project in north Novato, the county announced Thursday. Located at 8161 Redwood Blvd., the development would include 60 homes designated for low-income families, officials said. The proposed loan would help cover predevelopment and construction costs for the $84 million project, the press release noted. The site sits near the SMART rail station at San Marin Drive and within a few miles of downtown Novato. Sales prices for the homes are expected to range from $467,000 to $690,000. All units will be distributed through a lottery system, with Habitat for Humanity providing financial counseling and home maintenance training to qualifying families.

By Devan Patel

•

April 10, 2025

Microsoft has received approval to move forward with its North San Jose data center project , marking the first time the tech giant will build, own and manage a digital infrastructure facility in the South Bay. The San Jose Planning Commission has green-lit a conditional use permit that will allow Microsoft to build two data center buildings totaling approximately 397,200 square feet on a 64.5-acre site at 1657 Alviso-Milpitas Road. The data centers will have a maximum electrical load of 99 MW. “We’re very excited to get started,” said Jonathan Noble, senior director of government affairs at Microsoft. “We have been working on this project for a number of years. In fact, the original project was passed way back in 2017 (and) the vision for data centers out in this property, in this area of San Jose dates back to ‘91.” Even before the artificial intelligence boom put a greater emphasis on the need for data centers, Microsoft had eyed the North San Jose site near the Coyote River to bolster its cloud services and data processing business. At the time, it paid $73.2 million for the property and the company also floated another data center proposal in 2023 for a parcel at the corner of Orchard Parkway and Component Drive. The approval of Microsoft’s project also comes at a time when the company announced that it would be slowing down data center construction, including putting the brakes on plans for a $1 billion project in Ohio’s Licking County. Silicon Valley has seen a large influx of data center projects over the past few years as the region looks to capitalize on the interest in AI. Just this week, the San Jose City Council voted to fast-track two combined data center and housing projects envisioned by Westbank in the downtown area. Noble said that Microsoft’s project would help San Jose attract leading technology firms as the city needs more investment in digital infrastructure to maintain a competitive advantage. Along with the two data center buildings, a new 115 kilovolt substation will be constructed on the northwestern corner of the site and connect to PG&E’s Los Esteros Substation. While the project will take 33 months to complete, San Jose stands to receive several benefits both during and after construction. Microsoft has committed to making $65 million in infrastructure improvements, including the widening of Zanker Road and the rebuilding of bike lanes. Noble said the project would also create 100 construction jobs and the facility will employ 140 people once it is up and running. The project also will generate approximately $8.4 million in development impact fees and over $10 million in annual property tax revenue. Between taxes and fees, the city stands to receive between $3.6 million and $6.4 million in annual revenue.

LATEST NEWS

By Philip Molnar

•

April 16, 2025

San Diego voted Tuesday to ban software that it says is being used to illegally raise residential rents. The city council targeted software used by Texas company RealPage, which has been in federal crosshairs since August when the Biden administration filed an antitrust lawsuit against it. The Justice Department claimed the software’s algorithm allows landlords to view confidential information across competitors to align prices, avoid competition and keep rents high. RELATED: RealPage sues Berkeley over its ban on algorithmic rent pricing software San Diego, in an 8-to-1 vote, joins other cities that have banned the software, including Berkeley, San Francisco and Minneapolis. RealPage has sued Berkeley , is fighting the federal lawsuit and has not ruled out suing other cities that have banned its software. “This software weaponizes private data, from what should be competing landlords, to figure out just how high they can push prices,” said Councilmember Sean Elo-Rivera at a press conference ahead of the vote. RealPage attorney Michael Semko told the council it simply offers analysis of the rental market with a pricing suggestion, and less than 40% of the time do its clients go with the suggestion. “We don’t set rents,” he said. “The only way to lower rents is to build more housing. I think the ordinance is overly broad, it’s vague and invites scrutiny.” RealPage takes the data of millions of apartments, from hundreds of landlords, to give a user advice on what to charge a tenant. Landlords can still view signs outside of other apartment buildings or go on other complexes’ websites to see competing offers and figure out what to charge. The legal argument against RealPage is that it takes what should be confidential information from real estate management companies — such as exactly what a landlord is charging, instead of just viewing posted asking rents on websites — and incentivizes multiple landlords to collude on price. RealPage denies collusion allegations. It says its software might recommend to keep rents lower, or flat. It also says cities that ban its software are infringing on the company’s free speech rights to offer advice on rents. Lucinda Lilley, an apartment specialist who consults for several property management firms in San Diego County, told the Union-Tribune earlier this week that she does not use RealPage but was concerned about the ordinance because it constrains data gathering that businesses need. She said it sounded like the city didn’t want property managers to even conduct market surveys to figure out what rents are in the area. “What’s concerning is how far they want to go,” Lilley said. Elo-Rivera said the ordinance is only aimed at nonpublic competitor data, not public housing data sites, like Redfin and Zillow, or market surveys of rent prices. He said he worked closely with the city attorney to craft an ordinance not as broad as the Berkeley law, which didn’t expressly define the difference between noncompetitive, or nonpublic, data and public sources. The San Diego ordinance contains a carveout for landlords to use software from systems like RealPage after the data is 90 days old (nonpublic data not recommending rents). He argued the threat of a lawsuit was not reason enough to back off. “We can’t control whether or not folks sue,” Elo-Rivera said. “What I do know is I’m not going to be intimidated by big corporate executives and their threats to sue us to get us to try and not protect consumers.” The San Diego ordinance says if a tenant finds out their landlord is using rental algorithm software, they may seek damages of up to $1,000. Lilley said that was a concern for property managers because the law is targeting them for buying software, as opposed to going after RealPage directly. The ordinance does not specifically mention RealPage, only “algorithmic devices” used for rental rates, but the staff report cites RealPage several times as a justification for the action. The San Diego City Council voted 4-1 in October to have city staff frame an ordinance targeting the rental software. Only Councilmember Raul Campillo voted against out of concern it would get in the way of nationwide or statewide legal action against RealPage. On Tuesday, he again cast the lone dissenting vote, this time because of concern over specific language he wanted to add concerning a subsection of the ordinance. The law comes as San Diego County rent as been largely flat for more than a year. Real estate tracker CoStar said the average rent in the county, across all room types, was $2,513 a month, an annual rise of 0.6%, in mid-April. However, county rent has risen significantly since the start of the pandemic when average rent was $2,005 a month, representing a 25% gain in five years. The council meeting was attended by about 50 people, almost all in favor of banning the software. They held signs that said “Stop Price Fixing” and “Housing for All.” Alana Martinson, with Serving Seniors, said the low-income San Diegans her organization serves are devoting much of their fixed income to rent. “Older adults on fixed incomes are especially vulnerable to rent hikes,” she said. “A $100 increase, based on an algorithm, not real market conditions, can be catastrophic.” Recent UC San Diego graduate Nicole Lillie, who now works with youth-led nonprofit Our Time to Act, said many of her fellow graduates have left San Diego because they can’t afford to live here. “Our society, and its systems, have placed profit over people,” she said. “Gluttonous corporations, and landlords, find a million ways to squeeze every last penny from renters. One of their newest tactics has been using algorithms to artificially inflate our rents.” RealPage is facing additional lawsuits by the attorney generals of North Carolina and California. As San Diego’s city council was meeting, the North Carolina attorney general announced a settlement with one landlord, Cortland, who was sued for using RealPage. The company agreed to no longer use the software. North Carolina’s lawsuit against RealPage, and five other landlords, is ongoing.

By Sierra Lopez

•

April 16, 2025

PINOLE — Plans to build 154 homes on a 7.7-acre lot in Pinole cleared another hurdle Monday after planning commissioners approved a final map for the Appian Village project. Northern California housing developer DeNova Homes has been seeking to build its 154-unit residential project at 2151 Appian Way since 2021. The proposal calls for the construction of 26 three-story buildings, which would include both stacked flats and townhomes ranging in size from 1,249 to 1,825 square feet. The project will result in fully electric homes, 20% of which will be affordable units, according to city planning documents. Of the below-market-rate units, 15% will be listed at the moderate level for people earning up to 120% of the county’s median income and 5% will be at the low-income category for people earning up to 80% of the county’s median income. In Contra Costa County, the median income is $109,000 annually for a single-person household with a single low-income earner making about $84,600 and a moderate income earner making at least $130,800 per year, according to California Department of Housing and Community Development 2024 income levels. The homes will be built just south of Maloney Reservoir, across the street from Pinole Middle School on the former site of Doctors Medical Center, which closed in 2000 . The boarded up medical campus was demolished to make way for the new residential development. New infrastructure, including water, sewage and storm drainage, curbs, sidewalks, pedestrian paths and outdoor space will also be developed under the plan, according to city documents. Planning commissioners asked few questions and gave little feedback on the proposal during its Monday meeting but the project had already received various approvals in 2022, including an environmental review exemption, a comprehensive design review and a tentative subdivision map. The commission voted unanimously Monday to approve a final subdivision map, finding that it aligned with the tentative version adopted in 2022. Pinole Planning Manager David Hanham lauded the maps for their near identical configurations and said the DeNova development team has been easy to work with. “We’ve got a good working relationship with them and continue to move this project forward,” Hanham said Monday. Hanham and representatives with DeNova Homes did not immediately respond to requests for comment from this news organization.

By George Avalos

•

April 16, 2025

SAN JOSE — A developer is eyeing a “builder’s remedy” to fast-track well over 700 affordable homes in north San Jose’s Alviso district — and city planners say they are working with the developer to advance the project. The proposed development of 780 affordable residences would sprout next to the popular Topgolf entertainment and sports venue near North First Street, according to plans on file with San Jose city officials. he project’s developer, Cloud Apartments, hopes to determine whether the north San Jose project might land city approval through a fast-track builder’s remedy or a streamlined proposal. When cities or counties in California are out of compliance with state rules because they haven’t met their housing approval obligations, the builder’s remedy approach gives developers a way to overcome local barriers that can throttle affordable housing proposals. The 780-unit affordable housing proposal would be built on a 3.2-acre site at 7 Topgolf Way in Alviso, the planning documents show. “It’s important for the city to encourage more affordable housing near major job clusters like north San Jose,” said Bob Staedler, principal executive with Silicon Valley Synergy, a land-use consultancy. Years ago, the development site was part of the land that would have been needed for an “entertainment district” of restaurants, shops, hotels, and lively gathering places near the interchange of State Route 237 and North First Street. For an array of reasons, the entertainment district proposal fizzled, and the plans fell by the wayside. Now, this housing development and a nearby data center complex are poised to sprout on sites that would have provided the land for the entertainment district. Cloud Apartments, which uses modular construction techniques to save money and speed up production of affordable housing, is the developer of the proposed 780-unit complex. The housing developer is attempting to use provisions of two different state laws in hopes of a successful navigation of San Jose’s complex approval process. City planners are engaging with Curtis Wong, chief executive officer and founder of Cloud Apartments, on this project. “We are working closely with the developer on this,” Marika Krause, a public information manager with the San Jose Planning Department, said in an interview with this news organization. This proposal has emerged at a time when affordable housing is in demand in the Bay Area and San Jose. “We are happy they are building affordable housing there,” Krause said. In recent months, city planners issued a letter to the developer that sketched out some obstacles to the project that could have hobbled the development efforts. California’s builder’s remedy rules, however, are evolving, and the changes have left the city-issued letter outdated. “We are working sincerely with the applicant to allow their proposed density,” Krause said. “Builder’s remedy is a complicated law that’s been clarified a few times” in recent months. San Jose’s shifting assessment of the builder’s remedy rules is helpful, in Staedler’s view. “It appears the city is becoming more receptive to these kinds of projects than they were in the past,” Staedler said. “Getting more housing in north San Jose is always helpful.”

By Ryan Macasero

•

April 16, 2025

A group of downtown business leaders is suing the city of Menlo Park in an effort to block a proposed redevelopment of three parking lots into at least 345 units of affordable housing . The alliance, Save Downtown Menlo Park, filed a lawsuit against the city on Monday to stop its request for developer qualifications for the parking lots and to completely cancel that process. The lawsuit seeks to compel the city to follow the state’s Surplus Land Act, arguing the land must be declared surplus before development proposals can be considered. The group is also requesting the city pay their legal fees. City officials confirmed Wednesday that they are aware of the lawsuit but had not yet been formally served. “The city is releasing this information for transparency while it reviews the filing,” Menlo Park said in an emailed statement Wednesday. The complaint centers on whether the city has the legal authority to redevelop parking plazas 1, 2, and 3, located off Santa Cruz Avenue at Maloney Lane, Chestnut Street, and Crane Street. Opponents of the potential project argue that the redevelopment will remove more than 500 parking spaces, which they say will severely impact small business revenues, even if the removal is temporary. However, proponents and affordable housing advocates stress the urgency of building housing quickly on all available sites as the region grapples with a worsening housing crisis. Save Downtown Menlo Park argues the lots were acquired, at least in part, through eminent domain in the 1950s and that the city holds them in a “fiduciary capacity” — essentially acting as a trustee for public use, not for private development. The group points out that downtown property owners continue to pay special assessments to fund and maintain the parking, reinforcing their claim. The city disputes that interpretation. In a previous email to this news organization, Assistant City Manager Stephen Stolte said he was not aware of any law “that grants assessment payers a vested right in the assessment district improvements, provides that improvements shall perpetually remain in the same form, or provides that improvements may not later be changed or abandoned in the public interest.” The lawsuit also claims the city violated California’s Surplus Land Act by deferring a formal declaration that the land was surplus earlier this year — a legal step required before publicly owned land can be sold or leased — while still advancing the request for qualifications process. The city has not responded to that specific allegation as it continues to review the complaint. Seven developers have already submitted proposals, including Alliant Communities, Eden Housing, MidPen Housing, Path Ventures, Presidio Bay Ventures, Related California and Alta Housing, and The Pacific Companies and West Development Partners. All proposals include plans to replace or address parking and signal a willingness to collaborate with local stakeholders. Save Menlo Park’s lawyers have not responded to requests for comment. Since launching its campaign earlier this year, Save Downtown Menlo Park has collected more than 3,585 petition signatures and raised over $146,000 — mostly for legal expenses. Kevin Cunningham, a downtown property owner and one of the group’s lead organizers, previously said the city’s decision to move forward with the proposals has deepened frustration among business owners already uneasy about the city’s economic climate. The group, which maintains it is not anti-housing, has suggested that the city consider alternative sites — such as the Civic Center, two blocks away — to avoid disrupting downtown parking. Housing advocates argue that all viable sites must be considered to meet urgent demand. In addition to opposition from project critics, Menlo Park faces pressure from both state officials and local advocates to increase housing production, particularly in one of the region’s most expensive cities, home to tech giant Meta and several major venture capital firms. Amid a severe housing crisis, state regulators have in recent years been closely monitoring cities’ compliance with housing laws. Failure to follow through on approved housing plans — officially known as housing elements — can lead to decertification, exposing cities to the “builder’s remedy,” a legal tool that allows developers to bypass local zoning if 20% of the proposed units are affordable. Noncompliant cities also risk losing access to state and federal grants. Menlo Park’s state-approved housing element outlines plans for nearly 3,000 new homes by 2031. Across the Bay Area, cities are collectively targeting the construction of 442,000 units during the same period, according to the Association of Bay Area Governments.

By Bay City News Service

•

April 13, 2025

The Marin County Board of Supervisors is considering a $5.2 million loan to support an 80-unit Habitat for Humanity housing project in north Novato, the county announced Thursday. Located at 8161 Redwood Blvd., the development would include 60 homes designated for low-income families, officials said. The proposed loan would help cover predevelopment and construction costs for the $84 million project, the press release noted. The site sits near the SMART rail station at San Marin Drive and within a few miles of downtown Novato. Sales prices for the homes are expected to range from $467,000 to $690,000. All units will be distributed through a lottery system, with Habitat for Humanity providing financial counseling and home maintenance training to qualifying families.

By Devan Patel

•

April 10, 2025

Microsoft has received approval to move forward with its North San Jose data center project , marking the first time the tech giant will build, own and manage a digital infrastructure facility in the South Bay. The San Jose Planning Commission has green-lit a conditional use permit that will allow Microsoft to build two data center buildings totaling approximately 397,200 square feet on a 64.5-acre site at 1657 Alviso-Milpitas Road. The data centers will have a maximum electrical load of 99 MW. “We’re very excited to get started,” said Jonathan Noble, senior director of government affairs at Microsoft. “We have been working on this project for a number of years. In fact, the original project was passed way back in 2017 (and) the vision for data centers out in this property, in this area of San Jose dates back to ‘91.” Even before the artificial intelligence boom put a greater emphasis on the need for data centers, Microsoft had eyed the North San Jose site near the Coyote River to bolster its cloud services and data processing business. At the time, it paid $73.2 million for the property and the company also floated another data center proposal in 2023 for a parcel at the corner of Orchard Parkway and Component Drive. The approval of Microsoft’s project also comes at a time when the company announced that it would be slowing down data center construction, including putting the brakes on plans for a $1 billion project in Ohio’s Licking County. Silicon Valley has seen a large influx of data center projects over the past few years as the region looks to capitalize on the interest in AI. Just this week, the San Jose City Council voted to fast-track two combined data center and housing projects envisioned by Westbank in the downtown area. Noble said that Microsoft’s project would help San Jose attract leading technology firms as the city needs more investment in digital infrastructure to maintain a competitive advantage. Along with the two data center buildings, a new 115 kilovolt substation will be constructed on the northwestern corner of the site and connect to PG&E’s Los Esteros Substation. While the project will take 33 months to complete, San Jose stands to receive several benefits both during and after construction. Microsoft has committed to making $65 million in infrastructure improvements, including the widening of Zanker Road and the rebuilding of bike lanes. Noble said the project would also create 100 construction jobs and the facility will employ 140 people once it is up and running. The project also will generate approximately $8.4 million in development impact fees and over $10 million in annual property tax revenue. Between taxes and fees, the city stands to receive between $3.6 million and $6.4 million in annual revenue.

About Us

KELLER WILLIAMS

At KW Advisors, we share a special community that comes from our shared values. Our commitment to excellence, a productivity specific focused environment, high minded entrepreneurialism and service with a smile; while always doing the right thing with integrity.

$8.3B

2021 Sales Volume

$52.9B

Total Sales Volume (10-Years)

1.3K

Total Keller Williams Agents

5K

Total Properties Sold (10-Years)

Explore Neighborhoods

-

Monterey

Monterey is a coastal paradise that offers something for everyone, from the outdoor enthusiast to the culture seeker. With its stunning beaches, majestic redwoods, and abundance of marine life, Monterey is an ideal place to call home. The city of Monterey has a rich cultural heritage and a vibrant array of attractions. There are plenty of things to explore, like the Monterey Bay Aquarium, Fisherman's Wharf, and the historic Cannery Row.Learn More -

Santa Clara

If you're looking for the perfect place to call home, then look no further than Santa Clara! This stunning city is located just off the stunning Pacific Coast and offers a plethora of activities and amenities for all ages. Santa Clara boasts beautiful views, plenty of outdoor recreation, thrilling nightlife, and a welcoming community. With its close proximity to world-renowned Silicon Valley, you'll have access to some of the best job opportunities and a thriving tech sector.Learn More -

Santa Cruz

Living in Santa Cruz, CA, is like being on a permanent vacation! The coastal city offers something for everyone, from outdoor enthusiasts and beach lovers to those looking for a bustling downtown. Santa Cruz boasts some of the most beautiful beaches in California, along with miles of redwood forests, rolling hills, and extensive hiking and biking trails. With a mild Mediterranean climate that rarely sees snow, the area is perfect for year-round outdoor activities such as surfing, paddleboarding, kayaking, and even whale watching. For those looking for a vibrant urban atmosphere, Santa Cruz's downtown area is full of unique shops and restaurants, as well as historical attractions and landmarks.Learn More -

San Mateo

San Mateo is the ideal place to live for those who want to enjoy a life of convenience and opportunity. With its prime Silicon Valley location, San Mateo offers easy access to some of the best entertainment and job opportunities in the state. In addition, San Mateo is also home to a variety of outdoor activities, from surfing and swimming at the nearby beaches to hiking along scenic trails. San Mateo has something for everyone—from young professionals to families looking for a peaceful, suburban lifestyle.Learn More -

San Francisco

With its iconic bridge, historic cable cars, and beautiful Victorian architecture, San Francisco is undeniably one of the world’s great cities. The entire region, in fact, demands to be explored. The vibrant and diverse East Bay, with cities like Oakland and Berkeley, is a cultural and culinary hotbed. Napa Valley and Sonoma County produce some of the best wine in the world. San Jose and Silicon Valley are essential hubs of innovation. Plus, you’ll find quaint waterfront towns, incredible shopping, fantastic museums, and endless outdoor delights at Point Reyes National Seashore.Learn More -

East Bay

Explore the charm of this picturesque city, where historic landmarks, scenic parks, and a vibrant culinary scene await. Immerse yourself in the beauty of this coastal gem, boasting stunning beaches, a lively waterfront, and a rich cultural heritage.Learn More

Testimonials

- Bought and sold a Single Family home in 2010 in Los Altos CA

“Michael is an excellent agent whose knowledge of the real estate business, along with his sense of professionalism is his unique asset. Michael has a vast knowledge of the ream estate market in California, especially the San Francisco Bay Area. I have been extremely happy with his service and hope to get a chance to employ his services again soon.”bob202 - 10/18/2011 - It is with privilege that I write in reference to the outstanding service that Mr. Teymouri provided our family. His persistency, professionalism, tenacious attitude and knowledge helped us find the perfect and suitable home for our family. They guided us step by step through this process making our experience a pleasurable one.

I personally recommend Michael Teymouri to any individual interested in buying or selling a home. It truly is an eye opener.Ray. B - "Besides being a very nice guy and very patient with his clients, we found Michael to be extremely knowledgeable in the areas he covered. He is always willing to take that extra step to make things happen. You can always count on Michael to give his 110%."Easen H

- "Michael Provided services above and beyond the call of duty.... He has shown excellent insight in all property transactions" ...Conrad G.